Digital and non-touch interactions are now taking the centre stage. As a result, many service providers, including banks, are in a race to fully embrace digital transformation.

MB is positioning itself as the go-to financial institution for import-export enterprises by offering a plethora of cutting-edge services. In addition to being the first bank to launch products including online international money transfer and online foreign currency sales on BIZ MBBank, MB is also the trailblazer to provide import L/C services via blockchain technology on Contour’s platform since December.

“Digital first”, not “digital only”

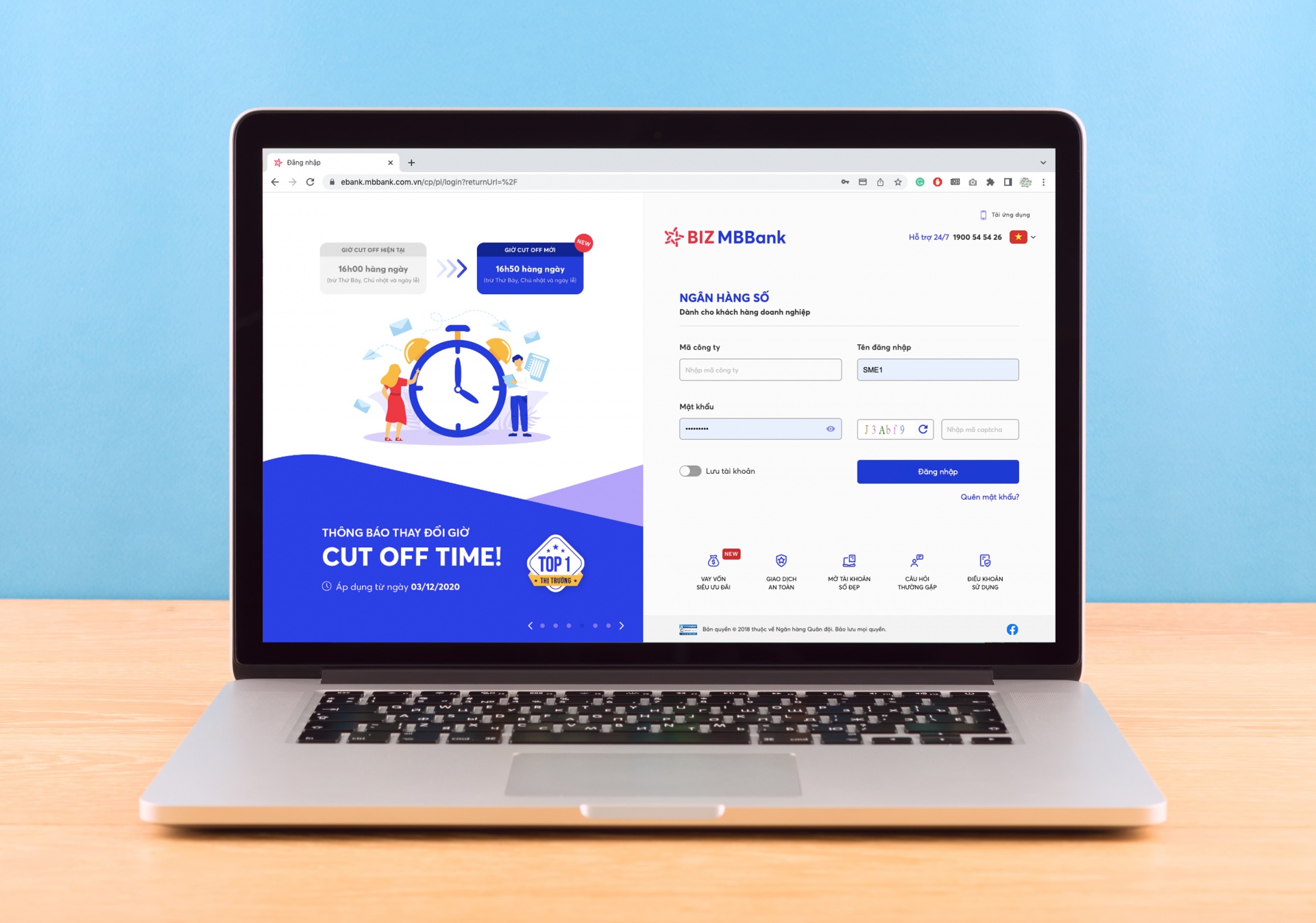

Due to the complexity of international payment and trade finance services, businesses engaging in import-export operations often have extensive advisory requirements throughout the process of putting their transactions into effect. Thus, digital products available to these firms on the BIZ MBBank platform prioritise access to top-notch banking services and consultants at all times.

For an online international money transfer service, MB consultants would jump in to provide tight assistance for customers.

BIZ MBBank also places a strong emphasis on proactive self-services. Businesses may now accomplish all they need to do in regards to international money transfers online via the app, including generating transfer orders, purchasing foreign currencies, adding documents, and querying transfers.

In addition, MB is among the pioneers in Vietnam to implement the SWIFT initiative, which allows clients to monitor the recipient’s receipt of money in real-time and at no extra fee.

Businesses with foreign currency sources on their current accounts may convert to VND for online foreign currency sales transactions on BIZ MBBank after their holding corporations approve their request.

MB is dedicated to providing a one-of-a-kind experience for each of its clients, which is why the MBBank BIZ interface includes the MBeeChat function for instantaneous communication with MB professionals

Through MBeeChat, customers could gain an upper hand thanks to its exclusive consultant on current exchange rate fluctuations.

More than threefold growth in the number of businesses adopting BIZ MBBank’s online marketplace to buy and sell foreign currency within one year has made it very evident how high-quality the platform is.

Swift and convenient services

MB is one of the most prominent banks in transformation efforts to assist clients to boost operation efficiency, and it offers unique services for enterprises engaging in the difficult process of importing and exporting.

Tran The Khai, director of Dinh Vu Chemical JSC, has witnessed firsthand how BIZ MBBank’s digital offerings for import-export clients have evolved.

“As an import-export business, we can sense the continual shift from MB’s products in order to enhance customers’ experience. Selling foreign currencies and transferring international money online may help businesses save time and money and improve efficiency compared to brick-and-mortar transactions,” he shared.

Conventional means of foreign money transmission required firms to spend many hours, not including travel time, just to conduct a single transaction. However, MB guarantees that all business transactions conducted via BIZ MBBank will be finalised within 60 minutes (applicable to transactions approved before 11am) automatically.

“The swift, digital-enabled, and timely services on BIZ MBBank are very significant when dealing with overseas transactions, which might help us to capture many potential prospects,” Khai added.

To achieve this goal, MB is continually working to enhance its internal processes and systems in order to boost the speed and quality of service delivery to consumers while maintaining a focus on providing seamless experiences across all channels.

MB has shown its dedication to its mission of being the best digital bank for import-export clients. Loans for wire transfers abroad, import advising services, and L/C issuance are just two of the many new products that the bank plans to roll out on BIZ MBBank in the near future.

Vietnam’s E-transaction Law: Some implications from international experience

Vietnam’s E-transaction Law: Some implications from international experience

In an effort to promote and grow the digital economy, Vietnam is in the process of revising its E-transaction Law which was first endorsed in the country in 2005.

MB maintains its position as the market leader in Vietnam

MB maintains its position as the market leader in Vietnam

Military Commercial Joint Stock Bank (MB) was awarded a prestigious award, the Best Financial Derivatives Provider in Vietnam, on July 22 at an online conference organised by The Asian Banker.

MB becomes the first Vietnamese commercial bank offering blockchain-enabled L/C services

MB becomes the first Vietnamese commercial bank offering blockchain-enabled L/C services

Military Commercial JSB (MB) becomes the first Vietnamese commercial bank to join the Contour network to provide blockchain-enabled letter-to-credit (L/C) services for import-export corporates.