This post may contain affiliate links.

I closed two savings account and transferred the money to GCash.

GCash is a mobile money service app regulated by the central bank of the Philippines. The app lets you buy things, send and receive money, pay bills, and more. It’s like having your wallet inside your phone.

Skeptical at first

I had the GCash app for months but I never used it. To buy things, I use a credit card or debit card. For bills payment, BDO and BPI’s online and mobile banking does the job. GCash had no place in my financial ecosystem. The only reason I downloaded it is because I love to fiddle with money-related apps.

I also never considered putting money inside the app. First, due to trust issues. I’ve encountered a lot of money problems in the past. This made me suspicious of whether the app is secure or not. Second, I don’t want money to be idle — not incurring interests.

Read: How We Killed 8 Credit Cards

A new feature caught my attention

But they caught my attention recently. GCash had partnered with one of the largest investment banks in Asia, CIMB. It seems they are serious about this mobile wallet thing. Their partnership gave birth to a new feature inside the app called GSave.

If GCash is a wallet, GSave turns that wallet into a savings account. Now, what made it special for me to transfer my savings? It’s because of their 3% interest rate! GSave is a high-yield savings account inside your phone.

Why this is a big deal

If it did not excite you, let me show why it’s a big deal.

GSave’s rate is 12x higher than the regular savings account.GSave 3% vs other banks 0.25% (a year)It’s almost 3x higher than other bank’s high-yield savings account. Plus, it has no minimum deposit and no maintaining balance.Other high-yield savings account has an average interest rate of 1.5%. But to qualify, you need to make a minimum deposit and maintain a balance of at least P30,000 to P50,000.It’s 3x higher than time deposits and has no lock-in period.Let’s take BDO’s Peso Time Deposit as an example.

You will need to lock-in P1 Million to P5 Million Pesos for 360 days to incur 1%.It more or less has the same rate as the Money Market Fund, but it’s more stable.

Before GSave, Money Market is where I park my cash. I still do, but I give more priority to GSave for now. Their rates are almost at par but I will give GSave a slight advantage because of its stability. GSave offers a guaranteed 3% while the Money Market Fund (MMF) may fluctuate from 1% to 3%. As of this writing, my MMF is at 2.05%.

Like any other savings account, PDIC insures the deposits in GSave.Philippine Deposit Insurance Corporation (PDIC)

RELATED: How do you earn in Ginvest? (Simplified, tips, stats)

There will always be a downside, but it’s still good

Of course, not everything is music to ears. Based on GSave’s FAQ, 3% is only an introductory interest rate. It expires after December 31, 2019. We hope they will continue to give high rates, but for now, we have this year to enjoy. Another matter we should also be aware of is GSave’s maximum account balance. To date, there’s a P100,000 threshold within 12 months from the day we opened an account. This means GSave won’t accept any more deposits beyond P100,000.

Yet considering all its perks, GSave still sounds too good to be true.

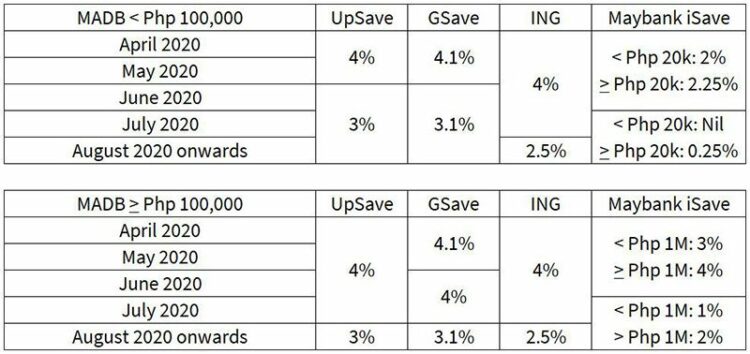

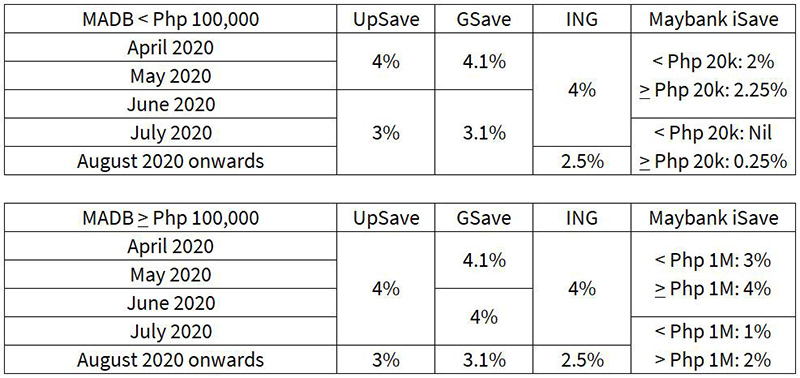

UPDATE:[January 6, 2020]: GCash/CIMB says goodbye to their 3% per year interest rate. Because now they offer 4.1% with no time limit! What great news![June 27, 2020]: 4.1% interest per year now only applies to accounts with P100,000 maintaining balance. For accounts below P100k, you can still enjoy 3.1%.

How come other banks couldn’t give the same rate? Well, CIMB Philippines is an all-digital bank. It means they do not have a physical presence. They don’t need to invest in brick and mortar, thus their maintenance costs are low. That’s the reason why they can be more generous compared to other banks.

You will appreciate it if you know inflation

We’ve been talking about interest rates, maintaining balance, lock-in period, and such. Yet you still don’t get what the buzz is all about? There’s a big possibility that you are not aware of “INFLATION.”

Fellow dads, it is important to know what inflation is. It’s an invisible expense eating our hard-earned money each year. To get yourself familiar with it will help you make better decisions for your family.

In simple words, inflation assures the cost to live next year will be more expensive. It guarantees the price of goods and services will go up. Like gravity, it’s a law. It’s something we can’t ignore. To make a decision without considering the law of gravity is to jump out a building and wonder why you are dead. In the same way, it’s unwise to complain when you can’t afford the same lifestyle you have last year. It should not surprise us if we know about inflation.

Read: How much do stay-at-home dads make? — My Actual Numbers

How inflation affects us and what should we do about it

The most practical way to beat inflation is to do something about it. As I write this, our country’s inflation rate is 3%. What does this mean? There are other technical ways to explain but I want to make things simple. To me, this means we are losing money at 3% a year. If you expose a block of ice to heat, little by little it melts away. To prevent this, we need to put it somewhere cold. Can you see the picture? Our money (block of ice) is always exposed to inflation (heat). It’s our job to place the block of ice in cold places so it can maintain, or even increase its value. To beat inflation, we should put our money somewhere where it can incur an interest rate of 3% or more.

Where are these cold places? It’s anywhere your money can incur interests. Like stocks, bonds, mutual funds, real estate, businesses, and more. Yes, a savings account is also a cold place, but people don’t bother because of the low-interest rate. 0.25% vs 3% inflation rate, a savings account isn’t cool enough. Money inside it still melts. But GSave’s 4.1% is an ideal temperature to maintain our money’s value, plus earn a little more.

Read: Time-saving apps: GCASH + ING

Closing thoughts

The act of putting money in those vehicles is called investing. But please don’t jump in without proper study. It’s best to consult financial advisors, read books, and learn finance basics.

In real life, we can lose money on investments. But with a savings account, we don’t have to worry. The rate is guaranteed, the amount is insured, our money is safe. It’s why to me GSave is a great place to park my money.

Note: GCash may change their mechanics, rates, policies and such without prior notice. Also, interest earned is subject to tax.

UPDATE:[June 27, 2020]: Aside from GSave, you can also put money in other similar accounts such as CIMB’s UpSave and ING.UpSave = 4% at P100,000 maintaining balance. (3% below maintaining)ING = 4% with no minimum balance. (But promo ends July 31, 2020)

Read: How To Better Myself At Home? Here Are 5 Exciting Masterclasses To Try

With these new rates, I’m inclined to transfer my savings back to the money market. It’s at 6% now.

[August 1, 2020]CIMB and GSave is back at 4% with minimum deposit of Php 1,000. — At least for August until September 2020.

ING also extends their 4% interest rate until August 31, 2020. Learn more here.[September 11, 2020]- GSave and CIMB still give 4% interest p.a. until September 30, 2020 — with Php 1,000 maintaining balance.- ING, on the other hand, has a more complicated approach moving forward. New users will get 4% interest p.a. for the first 4 months. While existing users get 2.5% p.a., but will get bonus interests when they saved more. Check out their promo page here.

[NOVEMBER 17, 2020]I made a follow-up post about this topic: Is It Still Smart To Save With GCash?