In 2016, I switched to N26. I left Commerzbank because they charge fees for everything. 6€ for using another bank’s ATM, 40€ a year for a basic credit card, 7€ a month for an account etc.

N26 is free. No withdrawal fees, no monthly fees, no credit card fees. Free! I can get money from the sketchiest ATMs in Berlin, and I do not pay any fees. This is not common in Germany.

I am an N26 customer since 2016. N26 has improved a lot since then, so I had to rewrite this review twice. This is my experience as an N26 customer in 2022.

This article was not suggested, written or approved by N26. I have done independent research, and these opinions are my own.

What are the benefits of N26?

I switched to N26 to save money. I didn’t want to pay fees to withdraw money. There are many other reasons to like this bank. Here they are, in order of importance.

There are no ATM withdrawal fees

With N26, you get 3 free withdrawals every month (before, it was 5)1. After that, you pay 2€ per withdrawal1. Most German banks charge 5-7€ to use another bank’s ATM. With N26, I haven’t paid ATM fees in years. I can use any ATM, even the sketchy ones in Spätis and train stations.

This is my favourite feature. I really hate to pay to access my own money. I also hate to walk a kilometre to the next free ATM. With N26, I see an ATM, I use it.

There are no monthly fees

Most banks now charge monthly fees, but N26 still has a free plan. This is why I opened an account in 2016. You can’t live in Germany without a bank account, so you should not have to pay for it.

N26 also has paid plans. Some of the paid features used to be free. You can live without them.

It’s 100% in English

The N26 app and website are in English. Their customer support is in English. When they send you a message, it’s in English. If you don’t speak German, this is very useful.

The app is also available in English, Spanish, French, Italian and German.

It’s 100% online

You can do everything in the N26 app. You never need to go to a bank. They never send you letters in the mail. This is great if you travel a lot.

For example, if you lose your bank card, you can block it and order a new one in a few minutes. If you receive a message, you can open it in the app.

With Commerzbank, I sometimes had to take a 45 minute train ride to sign some papers. I could only go to the Commerzbank branch where I opened my account. It was a big waste of time.

The exchange rates are low

The N26 MasterCard is good for travelling. There are no transaction fees and no currency conversion fees. You pay the real exchange rate1. You only pay a fee if you withdraw money in other currencies1. I used my N26 MasterCard in over 30 countries without any problems.

If you travel a lot, the N26 You and N26 Metal accounts include unlimited ATM withdrawals in all currencies, and travel insurance.

Push notifications for transactions

When money goes in or out of my account, I get a notification on my phone. I really love that feature. It helped me catch a few unexpected transactions. It’s also nice to get a notification as soon as you get paid.

The push notifications work instantly. My phone vibrate as soon as I buy something online or pay at the supermarket.

This was a unique feature in 2016, but now most banks have it. Kontist – my business bank – also notifies me instantly.

No Anmeldung needed

Some banks require a registration certificate (Anmeldebestätigung) to open an account. You get a registration certificate when you register your address. N26 does not require this document. If you just moved to Germany, and you don’t have an apartment yet, you can still open an N26 account.

For some passports, N26 also requires a residence permit. If this is a problem for you, there are other options.

German banks that don’t require an Anmeldung ➞

Support is available in English

N26 is still the only German bank that operates 100% in English. Most German banks don’t even have an English website. If you don’t speak German, N26 is one of the best options. The app is available in 5 languages: English, Spanish, French, Italian and German.

It takes 10 minutes to sign up

Opening an N26 account takes 10 minutes. You can open an account from anywhere in the world. All you need is a phone with a camera. You open the app, start a video chat, take pictures of your document and you are done. The registration process doesn’t always work perfectly, but when it does, it’s super quick. You get your bank card only a few days later.

…but there are other options!

N26 is fine, but you should still look at the other options.

ING, DKB, Comdirect and bunq don’t have ATM fees. Many banks let you open an account without an Anmeldung. bunq offers full English support. Deutsche Bank offers limited English support.

If I had to choose another bank, I would choose ING or DKB. If I didn’t speak German, I would choose bunq.

Comparison of German banks ➞

What do I dislike about N26?

There are also things I don’t like about N26. Here they are, in order of importance.

It used to be better

N26 fees and conditions get worse every year:

- When you open an account, you must pay 10€ to get a plastic MasterCard. It used to be free.

- The free account has 3 free ATM withdrawals per month. It used to be 5.

- If you keep more than 50,000€ in your account, you pay a fee.

- The free account does not include Spaces.

This is not just N26. All banks got worse. Every year, when I update my comparison of German banks, I notice more fees and more limitations.

There are no monthly fees

The standard N26 account is free. The free account is not as good as before, but it’s still great.

In 2022, most German banks have monthly fees. If you look at the N26 fee list, almost everything is free.

Banks with no monthly fees ➞

Some passports are not supported

When you create your account, you must start a video chat and verify your passport. Some passport types are not supported. If video ID doesn’t work, you must print a document and bring it to the post office. The person at the post office will verify your identity, and you will get your N26 card a few days later. The post office does not support all passport types either1, 2, 3.

If you can’t open an N26 account with your passport, these banks might accept your passport.

Banks for expats ➞

Only 3 free ATM withdrawals per month

In Germany, you always need cash. Fast food kiosks, Spätis and even some restaurants only accept cash. No credit cards or debit cards.

The free N26 account lets you withdraw money 3 times per month for free. After that, you pay 2€ each time you withdraw money. My account is older, and it still has 5 free withdrawals per month. It’s enough for me, but it’s not a lot. The N26 You and N26 Metal accounts have no withdrawal fees, but they have a monthly fee.

Only DKB and ING have no withdrawal fees. Other banks charge even higher fees to withdraw money.

Banks with no ATM fees ➞

Account creation problems (fixed?)

When everything goes well, you can open an account in 10 minutes. You open the app, start a video chat, show your passport to the customer service agent, and you’re done! A few days later, you receive your bank card in the mail.

It doesn’t always go well. Some people had problems when verifying their ID, or had to wait a long time for their new card. Others have to go to the post office to validate their ID. If you need a bank account right now, it’s very annoying.

This was a problem when I opened my account in 2016. It might be solved now.

Two-factor authentication issues

If you lose access to your phone, you lose access to your bank account. If you want to use the desktop website, you must confirm the login on your phone. If you want to transfer money from the desktop website, you must confirm the transfer on your phone.

If your phone is lost or stolen, you can’t pay the rent. Other banks have the same problem, but you can always go to a local branch. N26 doesn’t have a local branch. If this is a big problem for you, you should avoid online banks and choose a bank like Commerzbank, Deutsche Bank or Berliner Sparkasse.

It’s hard to get rid of coins

If I need to deposit cash into my N26 account, I use CASH26. Here’s how it works:

- The N26 app creates a barcode.

- You go to the supermarket, and the cashier scans your barcode.

- You “pay” the cashier, and the money is added to your bank account. It’s very easy.

How CASH26 works – N26.com

CASH26 does not work if you have a lot of coins. You must exchange your coins at the Bundesbank every few months. It’s not a big problem, but it’s annoying.

How to exchange coins in Berlin ➞

Other online banks have the same problem. Only Comdirect lets you deposit coins at Commerzbank branches. Traditional banks like Commerzbank, Deutsche Bank or Berliner Sparkasse let you deposit coins more easily.

Limited services

N26 is good for everyday banking, but it does not offer many investing options. If you want to invest your money, get a fancy credit card or get a mortgage, you need a traditional bank like Commerzbank, Deutsche Bank or Berliner Sparkasse.

You don’t need to have one bank for everything. You can have multiple bank accounts. I use Degiro to trade stocks, and Kontist as my business bank.

Slow customer support

The N26 support is not that good. I find the online chat very useful, but the agents take a long time to answer. Many people have complained about the slow support. It’s still nice to have support in English, especially if you don’t speak German.

N26 Smart and N26 You accounts have telephone support. N26 Metal accounts have a dedicated phone line. The free account only has chat and email support.

Bugs in the app (fixed!)

The N26 app works well in general, but it had bugs before. Sometimes, the app did not let me approve a transfer. It didn’t show any error; the “confirm” button just didn’t work. It happened when I had bad cellphone reception, even if I was on Wi-Fi. The app normally works well, but those bugs were frustrating. This bug is now fixed. I don’t have any other problems with the app.

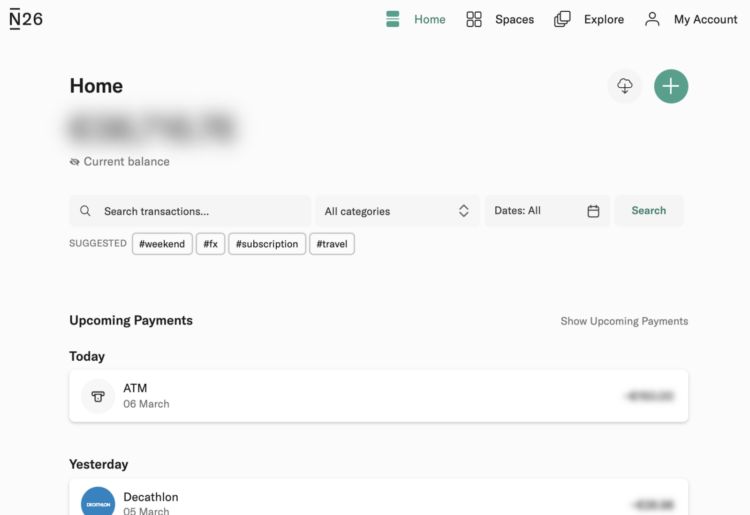

The N26 app

The N26 app has many cool features. These features make it easy to budget and save money.

Here are a few things I love about the N26 app:

- Push notificationsThis is my favourite feature. You get a notification for every transaction in your bank account. When I pay with my N26 card, I get the notification before the receipt starts printing. It helps you keep an eye on your spending and catch unexpected transactions.

- Spaces – screenshotSpaces are a simple but useful feature. Spaces are buckets in which you can put money. You can transfer money to the “Bills” space, or create a “Vacations” space with a 3000€ savings goal. You can even transfer money automatically. It’s a nice way to create a simple budget. This feature is only for paid accounts. It used to be free.

- Transactions and stats – screenshot 1, screenshot 2N26 automatically categorises your transactions. You can easily search through them, and see statistics for each month. Unfortunately, the statistics only show your spending. This is not very useful if you have irregular income. The N26 Smart, You and Metal accounts can automatically save a bit of money with every transaction.

- Google Pay and Apple PayN26 supports Google Pay, so you can pay by tapping your smartphone. I use N26 with Google Pay all the time. I rarely use my plastic card.

- Multiple language optionsThe app can be set to English, Spanish, French, Italian and German.

- Fingerprint login – screenshotYou can use your fingerprint instead of your password. It’s very reliable. You can deactivate this feature.

- Privacy mode – screenshotWhen you press the little eye icon, it hides your account balance and the amount of your transactions. I use this feature a lot.

Here are things I don’t like about it:

- No phone, no accessWhen you try to log in on the N26 website, it sends a notification to your phone. You must click the notification before you can login. If your phone runs out of battery, you can’t access your bank account. If you lose your phone, you can’t transfer money. Other online banks have the same problem.

- Incomplete translationsParts of the app are not completely translated to English. Some labels will still show in German. This is very rare, but it happens.

- MoneyBeamMoneyBeam is supposed to let you transfer money to other N26 users easily. In practice, if someone isn’t in your contacts, it’s faster to just use a bank transfer or PayPal. I never use this feature.

- BugsAs I wrote above, the N26 app was buggy in the past. It’s much better now.

Is N26 safe?

Yes. N26 is a regular bank, with 1500 employees and millions of users1. It’s not a startup. Your money is insured up to 100,000€1 by the German government. This is normal for all German banks.

Conclusion

Would I recommend N26? Yes. I use N26 as my only bank account since 2016. I travelled all over the world with my N26 MasterCard. I am happy with them, and that’s why I didn’t switch to another bank. Many of my friends also use N26, and they are also happy with it.

N26 has different account types. I use the free account. Since I opened my account a long time ago, I have better conditions. The current free account is more limited, but still very good.

Visit the N26 website – Compare N26 plans

If you just moved to Germany, N26 is a good bank to start with. You don’t need an Anmeldung, and you can do everything in English. The fees are low, and the N26 app is also nice (I love the push notifications and the spaces). The biggest problem is the slow customer support.

Is N26 the best bank for you? It depends. There are many other options:

- If you want an online bank with low fees, there is also comdirect, DKB, ING and bunq.

- If you don’t speak German, there is also bunq, Wise, Revolut, Monese, and Deutsche Bank.

- If you prefer a bank with branches you can go to, there is Commerzbank, Deutsche Bank and Berliner Sparkasse.

- If you don’t have an Anmeldung yet, there are many ways to open a bank account.

- If N26 does not support your passport type, Wise, Revolut, bunq and Monese support passports from more countries.

Comparison of German banks ➞