Are you looking for a MoneyLion review? Is MoneyLion a scam?

The MoneyLion platform provides a one-stop shop for digital financial services.

From afar, MoneyLion looks similar to other platforms, but it focuses on accessible and effective products for anyone with an interest in improving their financial standing.

With its integrated financial hub and cutting edge mobile app, MoneyLion makes it easier to overcome financial hurdles, including building credit and starting an investment account.

But since there are so many scams online, you may wonder if you can trust it or not.

I have a passion to help people explore the best money-making opportunities online, so over the years, I have reviewed hundreds of similar online platforms like MoneyLion.

In the past week, I have done thorough research about the MoneyLion, so I can tell you everything you need to know about it.

As a disclaimer, I’m not affiliated with MoneyLion, which means I’m not paid to write this review for MoneyLion. So you can be sure that my words are unbiased.

At the end of this MoneyLion review, I will tell you the best way that has enabled me to make a 5-figure income online.

In this MoneyLion review, I’m going to cover the following in this review:

What is MoneyLion?

MoneyLion, a mobile banking platform founded in 2013, offers credit-building loans up to $1,000, interest-free cash advances, early paycheck deposits and no minimum balance, managed investing, cashback rewards, and financial tracking and education.

MoneyLion has more than 6 million users and is headquartered in New York City.

MoneyLion breaks down traditional barriers to financial health by giving hard working Americans access to financial services, helping them take control of their finances and reach their goals.

MoneyLion uses artificial intelligence, superior analytics, and machine learning technologies to obtain a 360-degree view of its customers’ personal finances and provide them with highly personalized advice and underwriting.

A team of tech specialists and financiers used machine-learning technology to calculate individual spending patterns and provide tailored advice.

Consumers can also access small loans from MoneyLion to help manage their fluctuating monthly income and expenses.

By connecting a bank account or keeping their credit utilization low, customers receive points through a reward program.

MoneyLion‘s system mimics points-earning credit card programs like Chase Ultimate Rewards and American Express Membership Rewards.

Many awards have been given to them, including the Forbes Fintech 50 in 2020, Finovate Award for Best Digital Bank 2019, Benzinga Fintech Award for Innovation in Personal Finance 2019, and the Webby Awards 2019 People’s Voice Award.

It is free to open a MoneyLion account, which gives you access to both a checking account and an investment account. Account holders are eligible for cash advances up to $250 at 0% APR if they have an account.

Credit Builder Plus memberships cost $19.99 a month and include the features mentioned above along with the credit-builder loan.

Recommendation: Here’s The Best Alternative

Who Founded MoneyLion?

MoneyLion is led by CEO and co-founder Diwakar Choubey, who previously held high-level positions at Goldman Sachs, Barclays Capital, and Citadel.

MoneyLion’s chief information officer, Pratyush Tiwari, and chief technology officer, Chee Mun Foong, are also co-founders.

Having recently hired Jon Stevenson, former head of alternative investments at Stifel Financial, as head of its banking and wealth management division, MoneyLion is expanding consumer banking services via mobile phones.

In addition to its headquarters in New York City, the company has offices in San Francisco, Salt Lake City, and Kuala Lumpur, Malaysia.

The firm has raised $269.5 million in five rounds of funding, with the latest Series C round bringing in $160 million in July 2019.

Edison Partners and Greenspring Associates are among its top investors. Sanhua Capital, Fintech Collective, and Grupo Sura are also investors.

MoneyLion has used these funds to compete with both big and small fintech players.

MoneyLion’s profit, as well as its market value, is not disclosed.

Recommendation: Here’s The Best Alternative

What are the MoneyLion Services?

Mobile Banking

With RoarMoney, you get a fee-free checking account that’s FDIC-insured.

By setting up automatic direct deposits, you can receive your paycheck up to 2 days early.

There is no minimum balance requirement for this nearly fee-free account.

If you use your RoarMoney debit card with eligible merchants, you’ll receive cash back.

You can get a refund for the difference if you find something you purchased for a lower price.

Using RoarMoney, you can track your spending and plan your budget.

Instacash

The MoneyLion app allows you to apply for no-interest cash advances of up to $250.

For Instacash to work, you must have a checking account that is at least 2 months old, has a history of regular deposits, shows a positive balance, and is visibly active. As well as verifying your identity, you’ll need to verify ownership of the account.

You can request a cash advance via your app by tapping Request and specifying the amount and date of transfer.

Credit Builder Plus

Credit Builder Plus combines savings and credit building in one account. Small credit builder loans are available through this subscription service. If you apply, you won’t have to worry about a credit check and you can borrow up to $1,000.

With the Credit Builder Plus loans, you’ll build up your credit score over a 12-month period by paying on time.

In addition to credit monitoring, you’ll also get weekly updates on several credit-related markers, such as payment history and credit utilization.

RoarMoney and the MoneyLion app enable you to earn rewards and get Instacash up to $50 at 0% APR.

Your savings account will then contain the full amount of the loan, which you can then access and use at your own leisure.

Automated Investing

MoneyLion offers no maintenance fees or balance requirements for investing.

You can choose an investment time horizon and risk tolerance for your portfolio with Risk Slider.

Create a portfolio that’s personalized and customizable.

Dynamic rebalancing and fully automated investing are available.

For thematic investing, you can allocate your assets according to your goals, such as focusing on socially responsible investments.

Regarding auto invest, you can use a scheduled, automatic transfer from your linked bank account to contribute to your investment account regularly.

Your allocation can be adjusted as frequently as every 5 days in this long-term investment plan.

MoneyLion Crypto

It’s not available in New York or Hawaii, powered by Zero Hash

Crypto round-ups are a good way to buy Bitcoin

They provide 24/7 crypto buying, selling, and holding.

They also help manage Bitcoin and Ethereum.

Personalized Financial Tracking & Education

MoneyLion’s Financial Heartbeat is an app that keeps track of your finances like a fitness tracker.

MoneyLion’s Financial Heartbeat combines a simple yet dynamic framework for monitoring financial health, empowering members to improve on a daily basis based on their present financial situation.

Members can quickly see where they stand on their financial health journey by opening the MoneyLion mobile app and checking their Financial Heartbeat – a beautiful visual representation of a beating heart that changes colors based on progress.

MoneyLion Financial Heartbeat contains five key financial pillars: Save, Spend, Shield, Score, and Strive, and provides daily insights to improve members’ scores.

Smart Mobile Banking

MoneyLion’s banking solution, RoarMoney, is a partnership between MetaBank and Mastercard.

RoarMoney Offers:

- Received direct deposits up to two days early.

- Instacash SM advances up to $250 are available at 0% APR.

- 55,000 ATMs have no balance minimums or fees.

- Cashless MoneyLion Debit Mastercard® with Price Protection 3 and Zero Liability 4.

- Once you open your account, you will receive a RoarMoney virtual card.

- Spending reports by category every week.

- No hidden fees and transparent pricing.

How Does MoneyLion Work?

MoneyLion Account

You must have a MoneyLion account to use MoneyLion’s services.

MoneyLion allows for the creation of a free account, and it offers a range of free and paid services (such as Instacash advances).

In addition to a credit builder loan, credit monitoring, and access to other services, Credit Builder Plus costs $19.99 per month. MoneyLion charges a low, transparent fee and discloses it on their website.

MoneyLion accounts can only be opened by users who are 18 years old and have a bank account. Users can access MoneyLion’s services once they have created an account on the MoneyLion website.

Credit Builder Plus

A Credit Builder Plus membership has been proven to build credit. For $19.99 per month, you get:

- Credit Builder Plus Membership

- With competitive rates, you can borrow up to $1,000

- To build your credit score, you should report your payments to all three credit bureaus

- Monitoring and tracking your credit status 24/7 in the app so you can keep an eye on your progress.

- Cash advances with 0% APR are available with Instacash.

- With Lion’s Share, you can get up to $19.99 back per month in exclusive cashback rewards

- Checking Account (Free)

- Weekly Credit Score Updates and Credit Monitoring Service (Free)

- Standard Personal Loan Services of up to $3,000

- $1 Reward Deposited into Investment Account when You Log in Each Day

- $25 Rewards for Healthy Financial Status

- $5 up to $2,000 Bonuses for Referral Service

- Country-wide Access to 5,500 Free ATMs

- Plus Facebook Community Access

- Customized Investment Portfolio

- Managed Investment Account (Free)

Recommendation: Here’s The Best Alternative

How Does a MoneyLion Credit-Builder Loan Work?

A credit-builder loan can help build your credit with on-time payments due to MoneyLion’s reporting to the major credit bureaus.

MoneyLion promises credit-builder loans worth up to $1,000. You will be reviewed based on your finances and your linked checking account, and they will determine whether you are eligible for the loan and how much money you will receive.

When you are approved for one or more of the $1,000 credit-builder loans, MoneyLion members can access them immediately.

The funds that are not transferred to your checking account until your debt is fully paid will be held in an interest-bearing credit reserve account.

The APR ranges from competitive to high

MoneyLion credit-builder loans have interest rates ranging from 5.99 percent on the low end to 29.99 percent on the high end.

MoneyLion’s APR is low compared with other lenders for credit-builder loans, at 5.99 percent. It does not mean that you will be approved for a loan with this rate.

To determine what APR members are eligible for, MoneyLion takes into account a number of factors. MoneyLion charges $19.99 per month for its subscription.

Credit Builder Plus: A Chance To Offset Paid Membership

In order to qualify for a credit-builder loan, you need to become a Credit Builder Plus member and pay $19.99 per month. Your monthly subscription fee might be paid in part or in full via the payouts from their Share Loyalty Program.

This program pays MoneyLion participants if they sign up for the app and complete a certain number of transactions.

The Lion’s Share Loyalty program’s Platinum category is the highest. If they meet the following requirements, Platinum tier holders could earn $19.99 in their MoneyLion investment account:

To make at least 20 purchases (of $10 or more) per calendar month with the MoneyLion Visa Debit Card and to log in to the app every day.

Credit Score: No Credit Check

MoneyLion’s Credit Builder Plus membership does not require great credit scores to qualify for the credit-builder loan.

You don’t have to worry about your credit score with MoneyLion. To qualify for a loan, they examine your primary checking account, which must meet certain requirements.

Potentially Fast Funding

After MoneyLion checks your finances, it will deposit the loan amount into the bank account of your choice. All loan funds that you do not get upfront are deposited into a reserve account until the loan is paid off.

Based on your qualification, you can have the upfront funds transferred to your MoneyLion debit card or MoneyLion checking account immediately.

However, ACH deposits into a third-party checking account can take up to three business days.

You may have to wait a few days, depending on your bank, before you can access the funds.

Recommendation: Here’s The Best Alternative

Does MoneyLion Have Account Minimums?

For any account at MoneyLion, including your investment account, there is no minimum balance requirement.

It is possible that some features may require you to have a certain amount in your account. If you use Instacash, you must make sure you have enough to cover the automatic repayment deduction scheduled when you request an advance.

How Much Does a MoneyLion Loan Cost?

It offers loans with a term of up to 12 months for up to $1,000, but the exact amount depends on your state.

MoneyLion Plus subscribers will receive an APR ranging from 5.99 percent to 29.99 percent.

According to MoneyLion, this would mean that your monthly loan payment could be as low as $67.65. Costs could vary depending on the amount borrowed and the APR offered.

How To Qualify For a MoneyLion Credit Builder Loan?

To qualify for a loan from the credit builder, you would need to meet these requirements:

- Checking account open for at least 60 days

- Steady income source

- Good transaction history

MoneyLion does not run a hard check on you, nor does it require you to become a Plus member to open an account.

However, you will need to sign up for a Plus membership in order to be eligible for a Credit Builder loan.

Membership in Credit Builder Plus can be applied for using MoneyLion’s app. Please consider the following details before you apply:

No prepayment penalty

If you choose to pay off your credit builder loan early, MoneyLion will not charge you a prepayment penalty.

Access to deferment support

If you need to delay a payment in any case, you can apply to MoneyLion for deferment.

Free credit monitoring

If you see any error or suspicious activity on your credit report, you can access it for review. TransUnion powers this free service provided by MoneyLion.

Extra membership benefits

When you buy from participating brands, you get cash back. If you open a free MoneyLion checking account, you can take advantage of this perk.

Recommendation: Here’s The Best Alternative

Who A MoneyLion Loan Is For?

If you have trouble getting approved for a loan or are working on improving your credit, MoneyLion’s Plus membership can be an alternative for you.

If you need to cover an emergency, you should not rely solely on this credit-building loan. There is a very small amount, and some of the funds will be placed in a reserve account before the debt is paid.

You will significantly and positively build your credit history by making on-time payments on your MoneyLion credit-building loan. You can reduce your expenses by paying off the debt early to reduce interest rates.

A good match for people looking to improve their credit and drawn to MoneyLion’s other products may be this company.

What is the MoneyLion Fee Structure and Pricing?

MoneyLion is primarily a fee-free platform. The following services are fee-free:

- ATM withdrawal at 55,000 in-network

- Standard transfers

- Replacement cards

- Foreign transaction

- Account opening

- Stop payment

- Inactivity

- Return item

- Excessive transaction

MoneyLion charges fees only for out-of-network ATM withdrawals and automatic account funding.

A Credit Builder Plus account costs $19.99 per month plus your monthly loan payment. You will not be charged anything extra for your automated investing account – there is no minimum balance requirement and no management fee.

How is MoneyLion regulated?

Unlike banks, MoneyLion is a fintech company, or a neobank, or a challenger bank.

Despite this, Money Lion is regulated by the US Securities and Exchange Commission and is incorporated in Delaware, according to the SEC.

MoneyLion’s subsidiary, ML Wealth LLC, is an SEC-registered investment advisor regulated by the Securities and Exchange Commission and FINRA.

FDIC-member MetaBank, MoneyLion’s bank partner who issues your RoarMoneySM debit card and holds your MoneyLion debit card funds, issues your MoneyLion Mastercard.

Recommendation: Here’s The Best Alternative

How to Open a MoneyLion Account?

A MoneyLion account can be opened by anyone. With a MoneyLion Core membership, you get a MoneyLion RoarMoney fee-free checking account as well as a MoneyLion managed investment account.

When you have set up your account, you can also apply for a Credit Builder Plus account, which will allow you to apply for small credit builder loans up to $1,000. Your Credit Builder Plus account will be credited once you have paid off the loan.

The MoneyLion app is available in both the Apple App Store and Google Play. You can sign up on the MoneyLion website or by downloading the app.

Here’s the steps to follow:

Step 1: Apply Online

MoneyLion offers both a website and a mobile app for signing up. In order to get started, you must sign up with your full name and email address.

Step 2; Apply for a Credit Builder Plus Membership

Upon signing up, you will have the option to apply for a Credit Builder Plus membership and request a credit builder loan.

In addition to your name and address, you will need your social security number, address, phone number, and bank account number.

What is the Investment Style of MoneyLion Managed Investment Accounts?

MoneyLion Managed Investment accounts require you to fill out a short questionnaire.

MoneyLion aims to create a portfolio that meets your investing timeline and risk tolerance. They will design your portfolio based on your selection of five core investment portfolios, or, if you are a particularly discerning investor, from one of two portfolio designs at each end of the risk vs reward spectrum.

Asset allocation reserved and cautious for a steady income portfolio. Bond exchange-traded funds (ETFs) can help you grow your wealth.

You’ll usually get better returns here than in a savings account while protecting your investments from market volatility.

Conservative portfolio

With less focus on equity/stock ETFs and more on fixed income ETFs. The design provides higher liquidity and relative stability despite potentially lower returns.

Moderately conservative portfolio

Investing more in fixed-income ETFs and seeking more growth by shifting some weight to equity ETFs.

Moderate portfolio

A more balanced approach that seeks long-term growth while minimizing risk. ETFs with fixed income and equity components are mostly equal, but equity ETFs are slightly more popular. While this design is subject to volatility, it is usually less volatile than the market itself.

Moderately aggressive portfolio

Optimize long-term growth by introducing higher risk potential. Investments are allocated primarily to equity exchange traded funds, with income ETFs providing a buffer against volatility.

Aggressive portfolio

A large proportion of the portfolio is allocated to equity ETFs with less than 20% allocated to fixed-income ETFs. Enhanced volatility exposure with long-term returns as the focus.

Aggressive equity-only portfolio

Offerings designed for those who are seeking high returns can tolerate high levels of risk. A portfolio comprised entirely of equity ETFs, this portfolio is suitable for long-term investors who can tolerate volatility.

MoneyLion offers thematic investing as well for further personalization. To further streamline your asset allocation, you can include themes such as technology or socially responsible investing in your portfolio design.

You can also invest automatically, routinely from your deposit account. With steady and regular deposits, you can watch your investment balance grow as you choose how much and how often to transfer.

Recommendation: Here’s The Best Alternative

MoneyLion Pros

1. MoneyLion Has a Good Reputation

MoneyLion has generally received positive reviews from us. Based on internet research, there are many positive comments from people who have benefited from the company’s products and services.

Whenever MoneyLion encountered a problem, they responded quickly with a proposed solution.

2. MoneyLion Provides Good Customer Support

MoneyLion has impressive customer service options. The MoneyLion app includes a live chat feature and a chatbot for simple questions.

They can also be contacted by phone or by visiting their website.

3. MoneyLion’s Website is User-Friendly

In terms of both functionality and design, the MoneyLion site is both simple and elegant while staying true to the stated mission: “Rewire the American banking system to positively change the financial path for every hard-working American.”

Credit Builder Plus’ website is easy to navigate, and applying for a loan was very straightforward.

You can complete the application in less than ten minutes.

All the products and services they provide to members are well highlighted on their website.

4. MoneyLion Offers Competitive APR

MoneyLion’s Credit Builder Plus loan begins at 5.99% APR. For cash advances through Instacash, the APR is 0%.

5. MoneyLion Doesn’t Perform Hard Credit Check

All types of credit are eligible for the loans. Approvals can be obtained in minutes for customers who apply in the MoneyLion app and link a checking account.

6. The Cost of Using MoneyLion is Low

Instacash, MoneyLions’ 0% APR cash advance product, and other valuable features are included with the $19.99 a month Credit Builder Plus membership.

With their Lion’s Share rewards program, you can also earn back the membership fee.

7. MoneyLion Provides Quick funding

MoneyLion’s Credit Builder loan has the great feature of giving you a portion of the amount upfront.

It is possible to receive those funds instantly or within 48 hours (depending on your funding method).

After you pay off your full loan balance, the rest of the loan is held in a Credit Reserve Account in your name.

8. MoneyLion Allows Easy Repayment

Payments are fixed, so they won’t fluctuate over time.

There is also an early repayment option. MoneyLion does not charge a fee for early payoff. There is no additional fee for paying off your loan early.

9. MoneyLion Provides Transparent Fees

No surprises during borrowing, all fees are disclosed.

10. MoneyLion Provides Premium Services to Plus Members

For Credit Builder Plus members, the administrative fee for banking and investing is refunded, and they can earn exclusive Lion’s Share cashback.

Recommendation: Here’s The Best Alternative

MoneyLion Positive and Negative Feedbacks by Real Users

Making on-time payments to the MoneyLion Credit Builder Plus loan may help you improve your credit score, but may not be the best choice for your financial situation.

Before you pull one out, weigh the pros and cons.

MoneyLion Positive Feedbacks

- Same-day funding

- No credit check

- Weekly access TransUnion credit score

MoneyLion Negative Feedbacks

- $19.99 monthly membership fee

- Only a portion of your funds is available

- High APR at 29.99%

Is MoneyLion a Scam?

I cannot say MoneyLion is a scam. It is legit and legal to use MoneyLion’s online banking service, which utilizes the MoneyLion app as well as a secure website.

Its web and application processes are easy and standardized, it offers fair interest rates, and it offers stellar customer service.

According to Financer.com, MoneyLion is a great option for credit builder loans and other financial resources.

You may need to use a secure mobile process to sign in to your bank account when you sign up.

Like any legal lender, MoneyLion has a privacy policy that outlines what kinds of information it receives and how it uses it.

In contrast to other lenders or financial services, they will not check your credit score to decide whether to approve your application. It does, however, report to the main credit bureaus.

MoneyLion Review: Final Verdict

Here comes the conclusion of my MoneyLion review. Although MoneyLion seems to be a trustworthy company, I don’t recommend going into debt.

Instead, you should look for ways to make more money through a business. Building a digital asset is the best way to increase your income.

A digital asset doesn’t require you to worry about your credit score or your personal credit.

Since your business expenses are almost nonexistent, you don’t even have to bother going to lenders about a high credit limit in general.

With a simple website and a bit of on-page and off-page SEO, you’ll be at the top of Google in no time. Let me tell you more about this money-making opportunity in the next section.

Recommendation: Here’s The Best Alternative

The Best MoneyLion Alternative: Make Passive Income Online

You must be eager to make more money if you are reading this MoneyLion review.

Thanks to the Internet, the world has undergone a massive change in recent years. Making money online has become much easier nowadays.

There is nothing better than building a digital asset that generates cash flow for you while you sleep in order to grow your wealth fast.

In other words, it is absolutely possible to generate passive income instead of struggling to earn a living at a 9 to 5 job and live a financially free lifestyle.

Warren Buffet said, “If you don’t find a way to make money while you sleep, you will work until you die.”

If you really want to make a stable and secure stream of passive income, I would suggest you start an affiliate marketing business.

Affiliate Marketing is perfect for anyone who is new to online business.

So far, affiliate marketing has proven to be the easiest and most rewarding online business model I’ve used.

You can actually run affiliate marketing almost for free while earning a steady and sustainable passive income to pay your bills. Initial capital is not required, and it can even be done as a side hustle.

And if you really want to learn affiliate marketing and build a business from scratch, I’d recommend you to get started with the most reputable platform for affiliate marketing: Wealthy Affiliate.

Wealthy Affiliate is an all-in-one platform for building your affiliate marketing business from scratch. It offers you a free account (including a free website) with comprehensive training on SEO (free traffic methods), which enables you to get started with affiliate marketing right away without paying a penny.

But How Much Can You Earn in Affiliate Marketing?

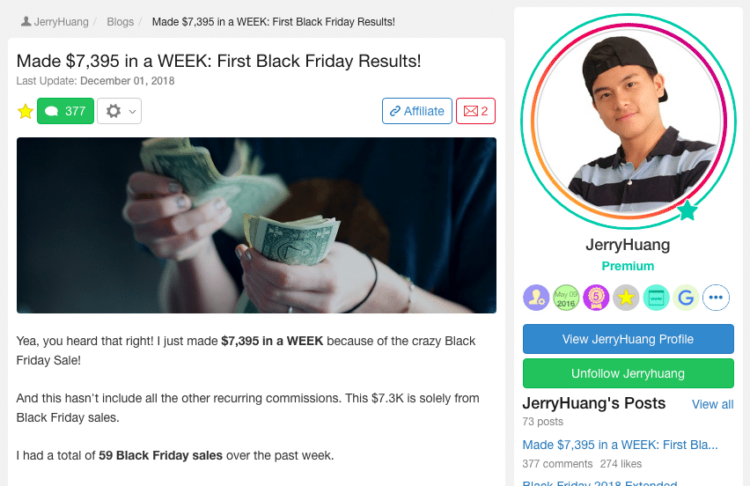

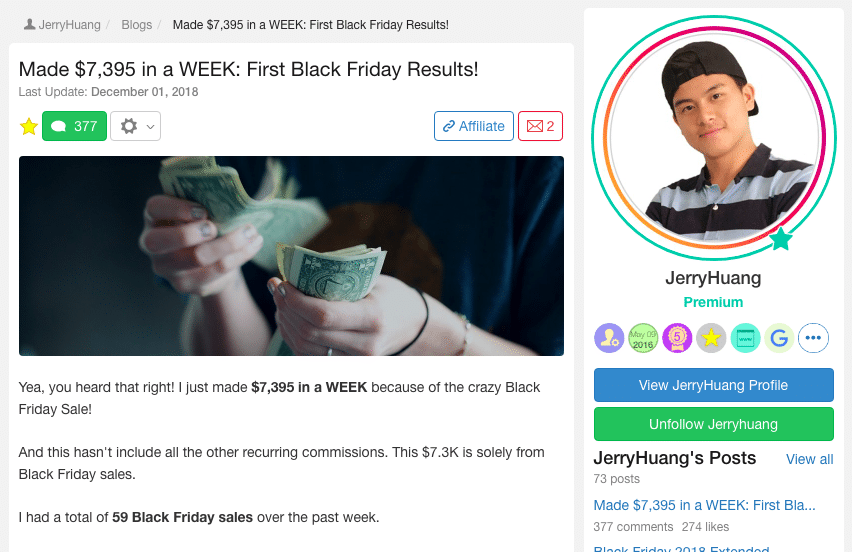

A 21-year old student from my #1 recommended training platform of affiliate marketing was able to earn $7,395 in just 1 week, which means he made more than $1k a day…all while using free traffic methods and affiliate marketing.

Wealthy Affiliate has existed for more than 10 years and there are many success stories over the years.

To give you more examples, here are some of the other inspiring success stories of Wealthy Affiliate members.

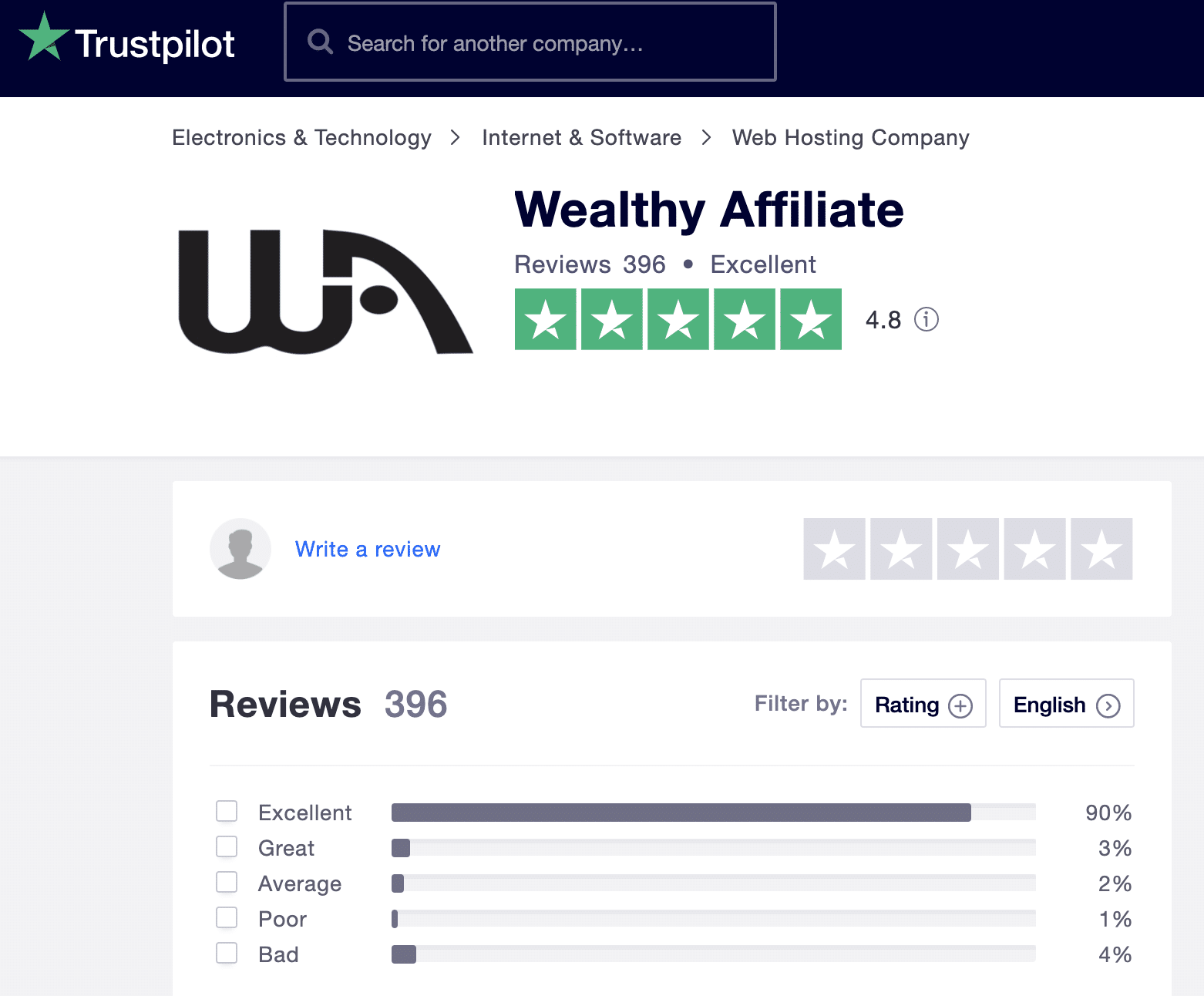

You can also visit Trustpilot where Wealthy Affiliate has 4.8/5 rating.

Where to Join Wealthy Affiliate?

Wealthy Affiliate has a very simple pricing scheme. It has free and premium membership.

If you want to feel about Wealthy Affiliate, you can sign up for the starter membership here (no credit card required). You can select to be a free member with no time limit.

And as a starter member, you can get instant access to the community, live chat, over 500 training modules, 2 classrooms, networking, commenting, 1 free website, access to the keyword tool.

You can enjoy all these values without paying a penny.

So I strongly recommend you to register a free account and see it yourself.

Recommendation: Here’s The Best Alternative

MoneyLion Review FAQs

1. Does MoneyLion Report To Credit Bureaus?

Yes, they do. They report your late, on-time, and missed loan payments to the major credit bureaus. If you make on-time payments with a credit builder loan, MoneyLion reports to all three major credit bureaus.

2. Is MoneyLion A Payday Loan?

You can enjoy your money with MoneyLion. The money you borrow from your check will be repaid to you by MoneyLion on your next payday with no interest.

3. Can I Deposit Cash Into MoneyLion?

You can add cash to your account by visiting one of the retail locations that uses [email protected] powered by Green Dot®.

The cash will be credited to your account after you swipe your MoneyLion Debit Mastercard. Crediting your account usually takes a few minutes.

4. How Long Does It Take MoneyLion To Process A Payment?

Lion’s Share payouts are usually credited to your MoneyLion Investment Account within five business days after the end of the month.

Credit Builder Plus memberships and loan payments must remain in good standing at the end of the month in order to receive a payout.

5. Is MoneyLion A Real Bank?

MoneyLion bank accounts are provided through Lincoln Savings Bank, an FDIC member, which means your money is insured up to $250,000.

6. Does MoneyLion Direct Deposit Early?

You can receive your direct deposits as early as two days in advance using the RoarMoney mobile banking app!

Paychecks will be deposited into your account as soon as they are received. Payments are transferred to your RoarMoney account at different times, so the timing varies.

MoneyLion, MetaBank, and Mastercard combine to make RoarMoney.

RoarMoney offers its users cutting edge mobile banking solutions, such as Mastercard Tap & Go® contactless payments technology, early paycheck delivery, and seamless integration with MoneyLion’s cash advances at zero interest.

7. With MoneyLion, do you get paid faster?

RoarMoney allows you to receive payments up to two days in advance.

RoarMoney and routing numbers are needed for this.

Payments can be connected to your RoarMoney account through the Get My Payment page of the IRS if you have government revenue.

8. Can I Withdraw Money From MoneyLion Account?

The investment account balance can be withdrawn as much as you wish as long as it is higher than the outstanding loan balance.

As an example, if your investment account balance is $1,000, the loan balance is $500 from which you can withdraw $495.

9. How Do I Withdraw Money From MoneyLion?

You need to submit a withdrawal request. Depending on the amount to be withdrawn, the active positions are liquidated and the funds are credited to your account.

With the MoneyLion Investment Account, it’s simple to withdraw your entire account balance.

10. What Happens If You Don’t Pay Money Lion?

You should remember that MoneyLion will try to recover your Instacash from your qualified accounts any time you skip a payment.

Depending on the balance in your account, your bank or credit union will either refuse or fund the transaction.

11. How Does MoneyLion’s Referral Program Work?

A $10 bonus is awarded to MoneyLion Plus members who refer friends to become Plus members. For every three friends you refer, you can earn a $5, $100, or even $2,000 referral bonus.

To refer your friends to MoneyLion, you will need to provide them with a referral code.

12. What are the MoneyLion Reviews And Complaints Online?

BBB accredited: No

BBB rating: C+

BBB customer reviews: 2.9 out of 5 stars, based on 104 customer reviews

Trustpilot Score: 4.5 out of 5 stars, based on 7,721 customer reviews

Despite receiving high ratings on the App Store and Google Play, MoneyLion Plus has received mostly negative reviews in recent months.

Many of them complain about poor customer service and difficulties with the entire loan process, which may result in their payments being recorded as late even before they are processed.

MoneyLion’s positive feedback is based on doing what they promise: improving their customers’ credit scores.

13. What Are Good Alternatives To MoneyLion?

Earnin: Earnin offers cash advance transfers, which can be a good option if access to cash is more important for you than building credit.

Self: If you are looking for a credit-builder loan that gives you the freedom to invest and save a little more money, Self may be worth considering.

14. Is My Money Safe?

On its website and app, MoneyLion uses encryption. It also monitors its site and database for threats 24/7. You can also lock a stolen card with MoneyLion’s app, which provides real-time transaction alerts.

MoneyLion adheres to strict privacy and information security practices. Rest assured, your information will be protected. FDIC-insured are your MoneyLion checking account and debit card. You may lose money if you invest.

15. How Do I Contact MoneyLion?

If there are no MoneyLion branches in your area, you can reach the company 24/7 by phone, email, or live chat. You can reach us by phone at 888-704-6970.

MoneyLion seems to offer superior customer service based on online reviews. Out of more than 21,000 customer reviews, the company has a 4.7/5 “Excellent” rating on Trustpilot.

16. Is MoneyLion Worth It?

MoneyLion offers many benefits, including interest-free cash advances and free ATM access. In addition to early direct deposits, cash back rewards, and investing, you also have access to early direct deposits. As a result, MoneyLion is a good all-in-one financial app to consider.

There are no fee-free MoneyLion accounts (RoarMoney, Investing, or Credit Builder Plus). Furthermore, both its Auto Invest and MoneyLion Crypto accounts have limited asset support. You can probably save a lot of money on fees if you’re willing to deal with opening up separate brokerage, banking, and cryptocurrency accounts.

Finally, if you find yourself needing small loans from time to time to tide you over for a few months, the Plus membership may be for you. Payback these loans as soon as possible since they are expensive.

17. Does MoneyLion offer credit monitoring?

With the $19.99 monthly membership for Credit Builder Plus, credit monitoring is included.

18. Can you cancel a Credit Plus membership early?

It doesn’t seem to be the case. The only way to cancel Credit Plus memberships without paying fees is to repay your Credit Builder Plus loan in full.

19. What is MoneyLion Overtime?

Overtime is a soon-to-be launched MoneyLion feature that will allow users to take out zero-fee installment loans between $50 and $600 over four months.

20. Is MoneyLion running any promotions?

MoneyLion doesn’t offer a signup bonus right now, but we’ll update this review if it does in the future.

21. What is the Cash Back Rewards Program of MoneyLion?

Customers can earn cashback on purchases every day with RoarMoney. This isn’t your typical cashback program.

In this case, the cashback is invested into the customer’s fully managed investment portfolio, where they can either grab it or let it grow.

22. How Does the MoneyLion Managed Investing Work?

You can invest and reach your goals faster with MoneyLion’s auto investing and fully managed portfolios – all without management fees or minimums.

In the app, MoneyLion asks you a few questions and then recommends a core portfolio based on the answers.

Personalize it by changing the amount of aggressiveness or adding investment themes like Future Innovations.

With MoneyLion, you can invest automatically and fund your account even faster.

Investment management services including trading and rebalancing are available for a low monthly fee of $1.

Credit Builder Plus members will receive a $1 reimbursement per month for the administrative fee.

23. Do You Have a YouTube Video For MoneyLion Review?

Yes, if you would like to watch a video reviewing MoneyLion, here it is:

Recommendation: Here’s The Best Alternative